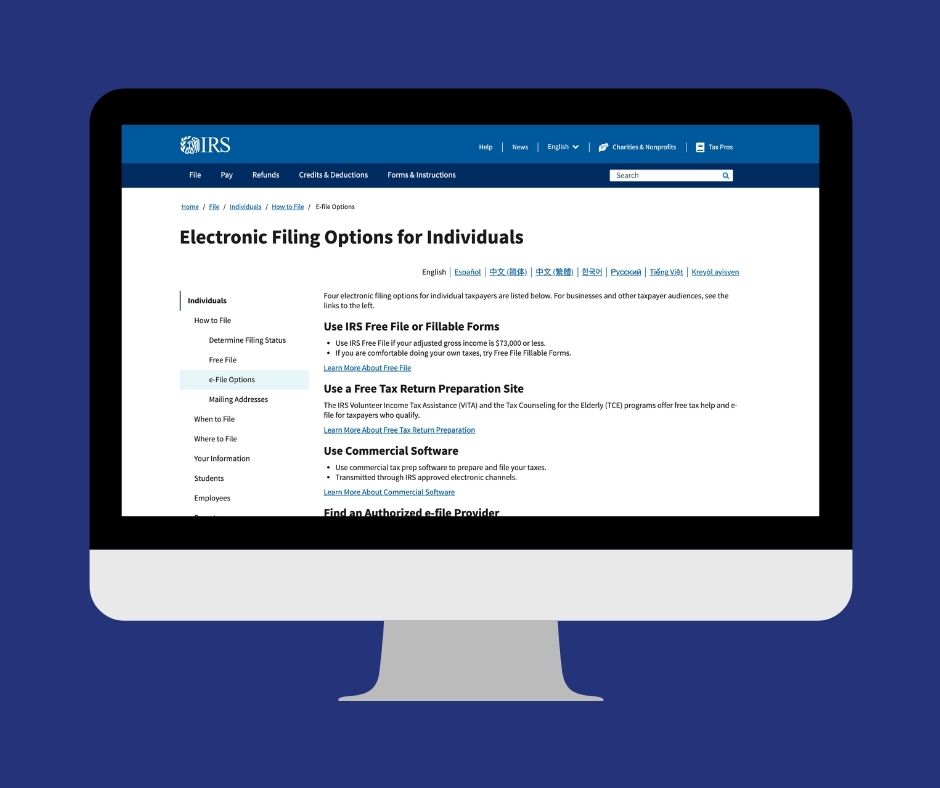

We can’t stress it enough this year: If you’re getting a tax refund and you want to see it anytime soon, you should plan to file electronically.

We can’t stress it enough this year: If you’re getting a tax refund and you want to see it anytime soon, you should plan to file electronically.

Not only that, but you should ensure that you are set up to have your refund direct-deposited to your bank.

The IRS has its hands full these days.

Processing issues brought on by the pandemic, coupled with the complexities introduced by the ensuing stimulus payments and tax credits, have meant that the IRS is experiencing delays in getting refunds out to taxpayers. That’s true even when the tax filing is neat and tidy with no out-of-the-ordinary issues.

Those delays are compounded by the workload that the U.S. Postal Service is currently experiencing, especially as it labors to meet the demand of delivering hundreds of thousands of free COVID tests requested by citizens nationwide.

So if you file your taxes the old-fashioned way and are expecting a refund check to come in the mail, settle in because you could be in for a long wait.

We’re talking about months, possibly many months.

As of now, for those who file their taxes electronically and request their refund distributed via direct deposit, the IRS estimates that taxpayers should see those refunds in about 21 days. Though nothing is ever quite certain with the IRS, three weeks is a reasonable expectation.

If you already have plans for how to use your state and federal tax refunds this year — paying off bills or funding a vacation — electronic filing is hands-down your best bet.

Plus, the sooner you file, the sooner you’ll see your refund!

We’re scheduling appointments now. You can also choose to walk in and be seen by the next available tax preparer. Or you can drop off your tax documents with us, and we’ll let you know when they’re ready for you to sign.

We’re here to make the tax prep experience easy, and we’ll do whatever works best for you.